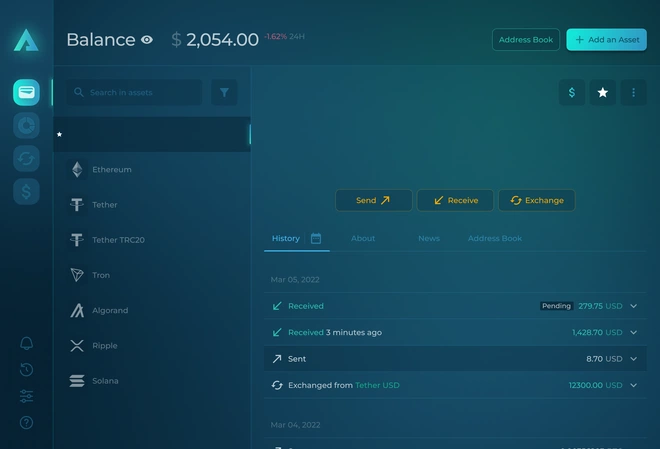

The Curve protocol is one of many automated market maker protocols on the Ethereum blockchain but its competitive edge is in its focus on stablecoins. DeFi traders also value Curve for ample opportunity for liquidity mining and yield farming. By providing liquidity to a pool, users receive a share of trading fees. There is still impermanent loss but with stablecoins, the risk of sudden market moves is essentially eliminated, so Curve is a safer alternative for traders to other AMMs.

Since August 2020, the Curve protocol is governed by the Curve DAO with CRV as its native token. CRV tokens are distributed along with interest to liquidity providers in proportion to the size of their contribution and the time committed to a pool. Therefore, the users who most actively contribute to the AMM are rewarded with voting rights and a tradable token.