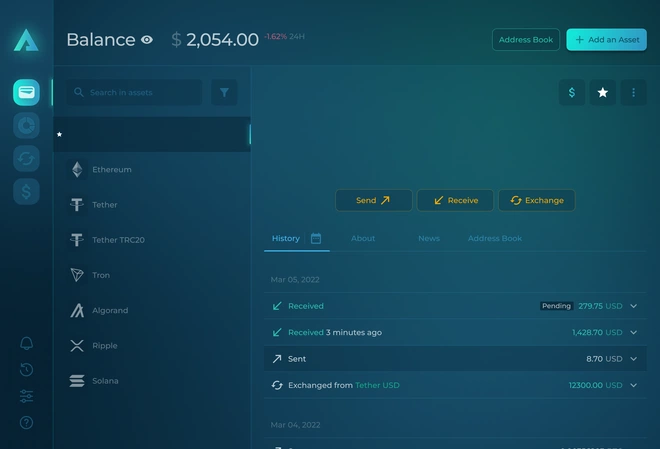

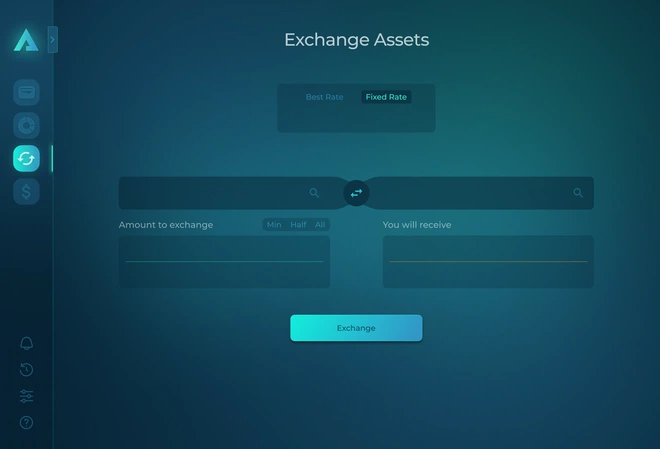

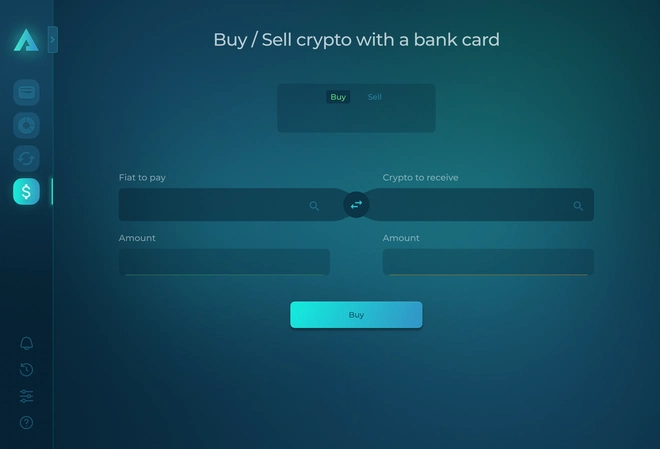

- Vaya a la pestaña Intercambio, elija Kyber Network como moneda para Enviar;

- Elija un criptoactivo que le gustaría recibir;

- Elija una Tarifa Mejor o Fija;

- ¿Listo? Empieza haciendo clic en “Intercambiar”.

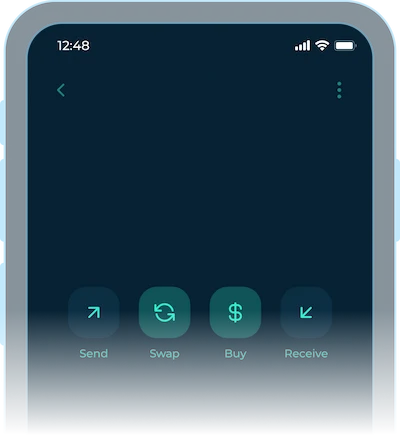

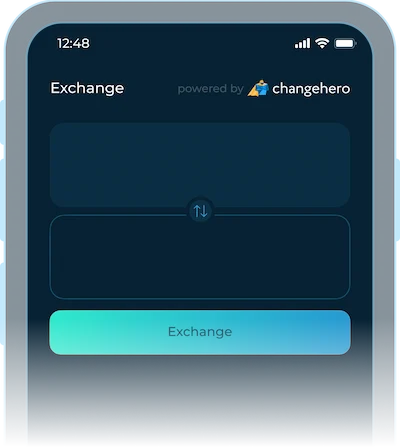

- Vaya a la pestaña Intercambio, elija Kyber Network como moneda para Enviar;

- Elija un criptoactivo que le gustaría recibir;

- Elija una Tarifa Mejor o Fija;

- ¿Listo? Empieza haciendo clic en “Intercambiar”.

It is more often than not decentralized finance platforms cannot boast the liquidity of their centralized counterparts. To alleviate this issue, Kyber Network connects various protocols with integrated liquidity providers and calculates the best rate for them. Kyber Network uses an advanced dynamic market maker (DMM) technology to match orders and minimize costs of operation while being entirely on-chain and transparent.

In line with the mission to uphold the values of decentralization, Kyber Network is governed by a decentralized autonomous organization KyberDAO. Like a lot of crypto DAOs, it makes great use of a native token KNC — Kyber Network Crystal. All significant decisions, even the total supply of KNC tokens, are put forward for voting to all KNC holders. KNC tokens were initially sold in a 2017 initial coin offering (ICO) but in mid-2021 migrated to a new contract. The previous version uses a KNCL ticker and coexists with the current one, but does not get as much utility.